South Africans face a heated debate on the National Credit Act amendments. The Department of Trade, Industry and Competition gazetted these changes recently. They aim to boost consumer protections and improve credit access for small businesses. Yet fears grow that they could trap young graduates in debt cycles.

What the National Credit Act Amendments Propose

On August 13, 2025, the department published draft regulations. Specifically, these updates target the National Credit Act of 2005. As a result, credit bureaus would gain access to information from educational institutions, including student debts. The goal is to strengthen affordability checks and curb reliance on loan sharks.

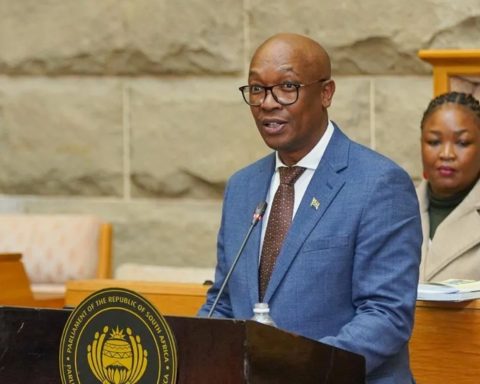

Moreover, Minister Parks Tau emphasizes that the focus remains on micro, small, and medium enterprises. He insists the changes promote economic growth for underserved communities. Public comments close on September 12, 2025, and the department commits to reviewing all inputs fairly.

Student Debt Crisis Sparks Outrage

Critics, however, slam the National Credit Act amendments as a blow to young people. For example, Sihle Lonzi, a youth leader, calls them discriminatory. He warns that the rules could blacklist graduates, thereby piling on economic hardship.

Similarly, an academic launched a petition with nearly 700 signatures. He argues that the proposed Regulation 18(7)(e) exposes indebted graduates to predatory lenders, further prejudicing those already struggling.

Youth Unemployment Fears Mount

In addition, student unions warn that the National Credit Act amendments could worsen youth joblessness. A spokesperson labels them “anti-progressive, anti-poor.” In fact, blacklisting might block graduates from loans and jobs, thus sidelining poor families from the economy.

Likewise, everyday South Africans echo this concern. They fear deeper financial distress for vulnerable youth, especially since the changes might list university debts on credit reports. This hits hard in a nation where student loans already burden many.

Officials Reassure No Blacklisting Intent

Nevertheless, the department pushes back strongly. It clarifies that indebted students face no blacklisting under the National Credit Act amendments. Furthermore, a media statement insists the proposals avoid prejudicing those with student debt.

Ministerial spokesperson Kaamil Alli vows robust stakeholder engagement. Similarly, Tau adds that the rules target MSME finance, not graduate harm.