The SA automotive industry closures trend is worsening. In the past two years, 12 firms have shut down and roughly 4 000 jobs have been lost. Therefore, industry leaders warn that without urgent changes, the sector’s decline will continue.

Production shortfall and localisation gap

In 2024, South Africa produced 515 850 vehicles, which is far below the South Africa Automotive Masterplan 2035 target of 784 509. Local content remains at 39%, well below the 60% goal. Meanwhile, 64% of vehicles sold locally are imported. This reliance on imports is weakening the manufacturing base and contributing to more SA automotive industry closures.

Trade Minister Parks Tau said that raising local content by only 5% could unlock R30 billion in procurement. As a result, this would far exceed the R4.4 billion potential from export growth.

Export challenges and tariff strain

Exports to the United States have faced added pressure. A 30% tariff, introduced in April, has affected R28.7 billion in trade. Government has submitted a revised trade proposal to Washington. Additionally, the aim is to secure tariff relief and protect jobs, preventing further SA automotive industry closures.

Incentives and new investment

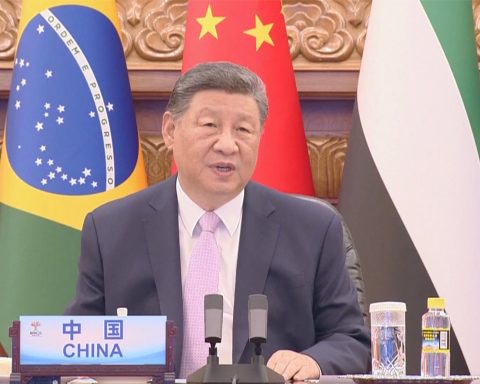

To counter the strain, government has expanded incentives to include electric vehicles and components. For example, Stellantis plans to build a new plant in the Eastern Cape. This project could help offset recent job losses. Meanwhile, Chery and other global automakers are exploring local production opportunities.

Data-driven transformation

Kevin Heunis, Ford of South Africa’s service engineering director, says the industry must adopt data-led approaches. By doing so, connected-vehicle analytics can enable predictive maintenance, enhance dealer training, and improve customer satisfaction. These steps could reduce future SA automotive industry closures.

Ford has invested R1 billion to upgrade 118 dealerships. Consequently, the upgrades combine institutional knowledge with modern systems, strengthening service delivery and building customer trust.

Outlook

Experts believe that localisation, targeted incentives, and a shift toward data-driven operations could revive the sector. Therefore, the trend of SA automotive industry closures could slow, preserving jobs and boosting economic growth.